Steps to Start an LLC in the State of Indiana: Quick Start Manual

Want to set up your enterprise in Indiana? Forming an LLC is a wise way to protect your individual finances and achieve managerial control. The registration procedure is not complicated, but you must meet local business requirements.

Let’s break down the essential steps to form your Indiana LLC successfully.

Understanding Indiana LLC Regulations

An LLC is a flexible option offering liability protection and tax benefits. The State of Indiana treats LLCs as separate legal entities, meaning your personal property are generally protected from your business liabilities.

To get your LLC started, you'll need to follow compliance procedures and cover filing costs. Indiana also requires regular compliance filings to keep your LLC in legal status.

Choosing a Business Name in Indiana

Pick a distinct name that follows Indiana naming rules. Your LLC’s name must include “Limited Liability Company,” “LLC,” or “L.L.C.” and must be distinguishable from existing business names in Indiana.

Check existing records using the Indiana Business Search Tool. Also, secure your matching web address for branding.

Avoid restricted words like “insurance,” “university,” or “bank,” unless you're licensed to use them.

Assigning Your Statutory Agent

Every Indiana LLC must assign a registered agent. This person or service will receive legal documents for your LLC.

Your registered agent must reside in Indiana and have a street address—no P.O. boxes allowed. You can be your own agent or hire a professional service for privacy.

Registering Your LLC Legally

Submit the Articles of Organization (Form 49459) to the Indiana Secretary of State. You can file digitally or with a paper form.

Provide your LLC’s name, principal place of business, agent details, and organizer’s name. Pay the filing fee—$95 online or $100 via mail.

After approval, you’ll receive a confirmation letter, and your Indiana LLC will be officially formed.

Creating Internal Rules for Your LLC

While Indiana doesn’t legally require an operating agreement, it’s highly recommended. This governing document outlines ownership structure, profit sharing, and dispute resolution procedures.

Even for single-member LLCs, this agreement reinforces your structure and solidifies legal boundaries.

Meeting Ongoing Compliance Needs

To remain compliant in Indiana, your LLC must:

Maintain a registered agent

File biennial reports with the Secretary of State

Pay state business taxes and license fees

Update any changes in get more info company details

Ignoring these responsibilities can lead to penalties, so stay proactive.

Conclusion

Forming your Indiana LLC can be manageable if you understand the process. Pick a compliant LLC name, appoint a reliable registered agent, submit your Articles of Organization, and keep your filings current.

With these essentials covered, you’ll establish your business in Indiana and position your LLC for growth.

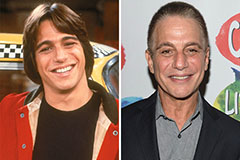

Tony Danza Then & Now!

Tony Danza Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Kane Then & Now!

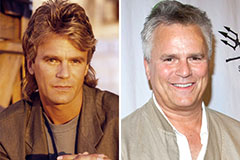

Kane Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!